Understanding the Urgency: Why Proprietary Preferred Provider Organizations Demand Attention

In a healthcare landscape where costs climb and access to quality providers is a constant challenge, employers, insurers, and injured workers all seek solutions that balance affordability, efficiency, and outcomes. One concept quietly reshaping the workers' compensation sector is the proprietary preferred provider organization. If you’re unfamiliar with what sets this approach apart, the time to take notice is now—because the structures behind treatment networks can mean the difference between millions saved or millions wasted.

Traditional approaches to managing medical care and costs are rapidly giving way to custom-designed solutions. Proprietary preferred provider organizations, or PPOs, introduce a layer of intentionality and oversight that standard networks simply can’t match. The result? Increased savings, tighter management, and access to high-quality medical professionals—outcomes that ripple outward to directly affect patient care and financial viability for employers and insurers. Yet, without a clear understanding of how proprietary PPOs work and how they’re maintained, many risk missing out on their critical advantages. That’s why delving into their structure and impact is so crucial for anyone involved in workers’ compensation or healthcare administration.

Ignoring the significance of proprietary networks could leave organizations exposed to unnecessary spending, compliance headaches, and less-than-optimal medical outcomes. As the industry evolves and more businesses look to tighten their processes, those who stay informed about proprietary preferred provider organizations will be best positioned to leverage smarter, more sustainable healthcare strategies.

Redefining Healthcare Networks: How Proprietary PPOs Deliver Superior Value and Control

At its core, a proprietary preferred provider organization is a custom-built network of contracted medical providers, meticulously managed by the organization itself. Unlike generic PPOs, which often broker access to a vast, undifferentiated pool of providers, proprietary networks are handpicked and specifically developed to meet defined needs—especially within workers' compensation. These organizations don’t just facilitate access; they build, maintain, and own each contract with the goal of delivering quality care and measurable savings.

This intentional curation means proprietary PPOs can negotiate terms that maximize both care quality and cost-efficiency, sidestepping some of the hidden expenses and administrative inefficiencies plaguing broader networks. By holding the reins on network governance, the managing organization can ensure providers meet higher standards and align with specialized requirements, such as state-specific fee schedules or industry guidelines relevant to occupational health. Without this proactive management, costs can spiral, savings are diluted, and injured workers may wait longer for the care they need—resulting in increased downtime and potential legal complications for employers.

The implications are profound: employers and insurers utilizing proprietary preferred provider organizations enjoy not only increased accuracy and savings but also more predictable outcomes in medical care. For anyone navigating the complexities of workers’ comp, grasping these differences can shape policy choices, negotiation strategies, and long-term planning—preventing missed opportunities for both financial and clinical success.

Why Proprietary PPO Networks Transform Workers’ Compensation Outcomes

As an industry expert, Employers Choice Network exemplifies the concrete benefits achievable through a well-managed proprietary preferred provider organization. By establishing, maintaining, and directly managing each PPO contract, such organizations offer unparalleled precision and customization within the workers’ compensation market. This careful oversight fosters relationships with quality medical providers who understand the nuances of occupational injuries and the importance of efficient return-to-work timelines.

The outcome extends well beyond cost containment. Employees benefit from timely access to reputable specialists and tailored treatment plans, while employers experience fewer claims disputes and greater transparency in billing. Proprietary PPOs generate accurate, increased savings versus generic networks because each provider is selected for both expertise and value—instead of being passively aggregated based on geography or generic credentials. This distinct approach directly answers the demand for prompt, high-quality care in a sector where every day counts. Clients ranging from major universities to insurance trusts have already realized savings in the millions, highlighting the far-reaching impact of this strategy.

The Evolution of Provider Networks: From Generic Access to Specialized Expertise

The development of proprietary preferred provider organizations echoes larger shifts in healthcare. Historically, PPOs took a broad-brush approach, granting patients access to vast lists of providers but offering little in the way of specialized oversight or meaningful negotiation on behalf of employers. Over time, as costs soared and the limitations of a generic approach became clear, industry leaders sought greater control and accountability.

By building proprietary networks, organizations now shape provider participation around the unique demands of the workers’ compensation landscape. This includes not only contracting with quality specialists and physicians but also cultivating a roster of providers who understand billing practices, state-mandated fee structures, and medical literature relevant to occupational injuries. It’s a deliberate evolution—one that acknowledges the need for both savings and clinical excellence.

Medical Bill Review and Hospital Auditing: Essential Pillars Supporting PPO Performance

Proprietary PPO networks are often complemented by rigorous medical bill review and hospital bill auditing. These processes, expertly provided by organizations like Employers Choice Network, ensure that every billed charge aligns with official state fee schedules and the specifics of each injury. By separating charges that are unrelated to workplace injury from those that are truly compensable, these audits prevent financial leakage and guarantee that cost savings are not just theoretical, but real and measurable.

The synergy between custom PPO management and detailed auditing delivers dual protection: prompt, appropriate care for injured workers and strong financial stewardship for clients. Given the intricacies of medical billing and frequent coding ambiguities, this layered approach mitigates error, fraud, and unnecessary payments—resulting in sustainable long-term results for health plans and employers alike.

Custom Provider Search Tools: Enhancing Accessibility and Decision-Making

Another innovation within proprietary preferred provider organizations is the deployment of advanced provider search capabilities. Stakeholders can search for specific types of specialists, locate providers within a tailored radius, and even construct employer-specific physician panels. This level of search granularity supports informed decision-making and greater employer empowerment.

For businesses managing geographically dispersed workforces or those with niche clinical needs, access to such tools allows the creation of customized provider directories and helps ensure the right care is never far from reach. Comprehensive search functionality also bolsters compliance and simplifies the task of aligning provider choice with corporate values and cost control strategies.

Employers Choice Network’s Approach: Elevating Network Management Through Experience and Precision

The philosophy behind Employers Choice Network emphasizes both integrity and innovation in network management. Drawing on over two decades of industry expertise, the organization’s principals have repeatedly advanced the standards of PPO development, medical bill review, and hospital auditing within the workers' compensation sector. Their mission centers on leveraging this depth of experience to build proprietary networks that are not just functional, but transformative—delivering increased accuracy, measurable savings, and sustained client satisfaction.

Central to this approach is the commitment to managing every aspect of each PPO contract, ensuring provider quality and aligning with specific market demands. The structure is further reinforced by sophisticated claims auditing and provider vetting, which together foster a culture of continuous improvement. As a result, clients benefit from efficient, transparent processes that directly address industry pain points—from repetitive billing errors to fragmented care delivery. This methodical yet flexible mindset positions Employers Choice Network as a thought leader in custom network design, responsive policy implementation, and long-term cost stewardship.

The company’s track record with clients such as major universities, healthcare systems, and insurance trusts illustrates the tangible impact of this philosophy. By merging flexibility and rigor, Employers Choice Network continues to set benchmarks for value and reliability in the proprietary PPO space.

Client Outcomes and Trust: Seeing Change in Action

While statistics provide strong evidence of success, the stories of organizations who’ve adopted proprietary preferred provider organizations bring the benefits to life. Although there are no public reviews currently listed for Employers Choice Network, their roster of high-profile clients—including Duke University, Carolinas HealthCare System, and large insurance consortiums—demonstrates the substantial trust placed in their methodology and processes. These partnerships signal more than transactional relationships; they speak to a history of consistently delivered results and client confidence in both day-to-day management and high-stakes decision-making.

When organizations leverage a proprietary preferred provider organization, they are not just selecting a vendor—they are embracing a strategic partner capable of reshaping financial and clinical outcomes. Moving toward this model is a step toward clarity, accountability, and peace of mind for all stakeholders involved.

Why Proprietary PPOs Will Shape Tomorrow’s Workers’ Compensation Programs

As healthcare and workplace injury cases grow more complex, the need for intelligent, adaptive network solutions has never been greater. Proprietary preferred provider organizations—designed, managed, and refined by leaders like Employers Choice Network—have emerged as the gold standard, setting a higher bar for quality, savings, and provider accountability. By investing in network ownership and process oversight, organizations future-proof their workers’ comp programs and position themselves to meet the shifting demands of both clients and regulatory environments.

The proprietary model’s proven advantages point towards a future where customized provider networks become less of a luxury and more of a foundational necessity. Through ongoing innovation, experience, and relentless focus on results, influential contributors to the field are expanding what’s possible in cost containment and patient care. Proprietary preferred provider organizations aren’t just changing the present—they’re setting new standards for the years ahead.

Contact the Experts at Employers Choice Network

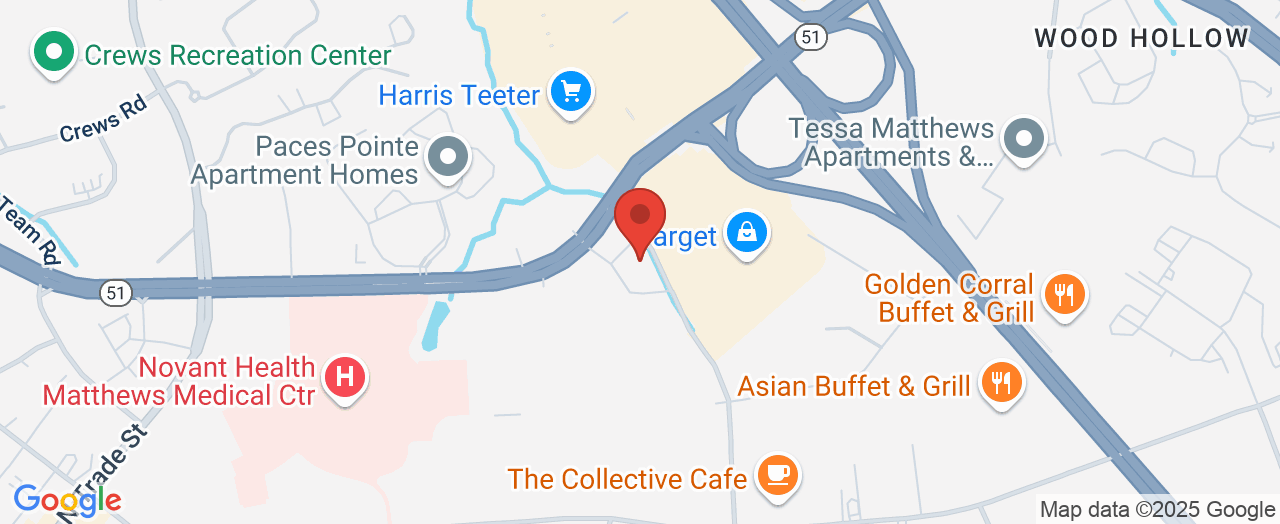

If you’d like to learn more about how a proprietary preferred provider organization could benefit your organization’s approach to workers’ compensation, contact the team at Employers Choice Network. 📍 Address: NBG Tower, 10590 Independence Pointe Pkwy, Matthews, NC 28105, USA 📞 Phone: +1 704-845-0713 🌐 Website: http://www.employchoice.com/

Employers Choice Network Location and Availability

🕒 Hours of Operation: Please contact Employers Choice Network directly for the most up-to-date business hours.

Add Row

Add Row  Add

Add

Write A Comment